Chemical Production Comparison Tool

India doesn’t just make chemicals - it makes them at scale. By 2025, India stands as the third-largest chemical producer in Asia and the sixth-largest in the world. That’s ahead of countries like Germany, Italy, and Canada. It’s not a surprise when you look at the numbers: India produces over $200 billion worth of chemicals every year, with exports hitting $65 billion in 2024. The country’s chemical industry is growing at 7% annually, faster than the global average of 4.5%.

How India Got to Number Six

India’s rise in chemical production didn’t happen overnight. It started with a push in the 1950s to become self-reliant in basic chemicals like fertilizers, dyes, and caustic soda. Over time, the government built industrial clusters in Gujarat, Maharashtra, and Tamil Nadu. These zones became hubs for petrochemicals, specialty chemicals, and pharmaceutical intermediates.

Today, India’s chemical sector is split into three big buckets: basic chemicals (like chlorine and sulfuric acid), specialty chemicals (used in cosmetics, agrochemicals, and electronics), and pharmaceutical chemicals. The last one is the real engine - over 40% of India’s chemical output feeds into drug manufacturing. That’s why companies like Dr. Reddy’s, Sun Pharma, and Aurobindo rely so heavily on domestic chemical suppliers.

The real game-changer? Low-cost manufacturing. Labor and raw material costs in India are significantly lower than in China or the U.S. That’s why global giants like BASF, Dow, and LyondellBasell have set up joint ventures or expanded plants here. In 2023 alone, foreign direct investment in India’s chemical sector crossed $4.2 billion - up 28% from the year before.

What India Produces - And What It Still Imports

India makes a huge range of chemicals. It’s the world’s largest producer of **dyes and pigments**, supplying over 60% of the global market for reactive dyes. It’s also a top-5 producer of **pesticides**, **pharmaceutical intermediates**, and **sodium carbonate** (used in glass and detergents).

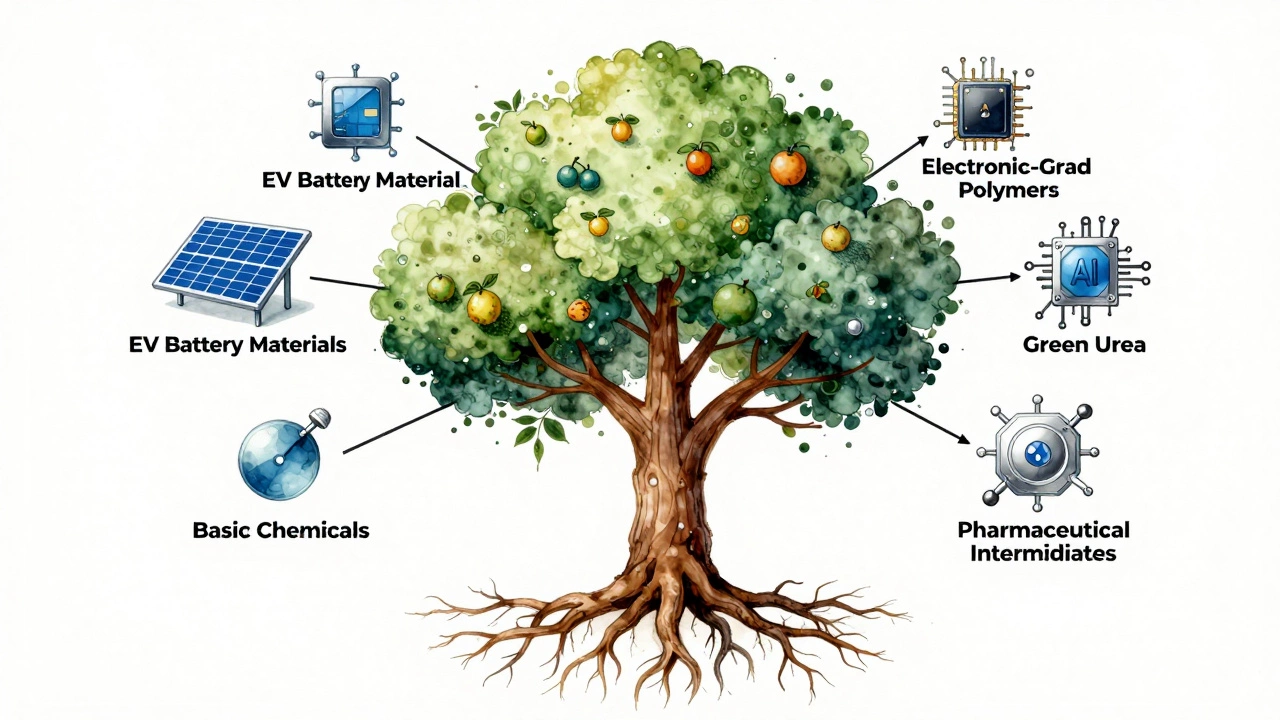

But here’s the catch: India still imports a lot of high-end stuff. The country imports over $12 billion worth of specialty chemicals every year - things like advanced polymers, electronic-grade chemicals, and catalysts used in electric vehicle batteries. That’s because producing these requires ultra-pure materials and complex processes that Indian factories haven’t fully mastered yet.

For example, India makes most of its own lithium-ion battery electrolytes, but still buys the lithium salt precursors from China. It produces bulk polyethylene, but imports high-density polyethylene (HDPE) grades used in medical packaging from Germany and South Korea.

Top Chemical Manufacturing States in India

Not all of India’s chemical production is spread evenly. Three states dominate:

- Gujarat - Accounts for nearly 40% of India’s chemical output. Home to the Dahej and Hazira industrial zones, it’s the heart of petrochemicals and bulk chemicals. Reliance Industries alone runs the world’s largest integrated petrochemical complex here.

- Maharashtra - Makes up about 25%. Mumbai and Pune are hubs for specialty chemicals, dyes, and pharmaceutical intermediates. Companies like UPL and CIPLA have major plants here.

- Tamil Nadu - Around 15%. Known for agrochemicals and fine chemicals. The Chennai-Puducherry corridor is a growing center for export-oriented chemical manufacturers.

Other states like Andhra Pradesh and Odisha are catching up fast, thanks to new investment zones and easier environmental clearances.

How India Compares to the Top Chemical Producers

Here’s how India stacks up against the global leaders in 2025:

| Rank | Country | Annual Output (USD) | Key Strengths |

|---|---|---|---|

| 1 | China | $1.5 trillion | Scale, vertical integration, cheap feedstock |

| 2 | United States | $780 billion | Advanced specialty chemicals, innovation |

| 3 | Germany | $210 billion | High-purity pharmaceutical and electronic chemicals |

| 4 | Japan | $190 billion | Electronic-grade materials, catalysts |

| 5 | South Korea | $170 billion | Petrochemicals, battery chemicals |

| 6 | India | $200 billion | Pharmaceutical intermediates, dyes, low-cost bulk |

India’s output is close to Germany’s - but Germany’s is mostly high-value specialty chemicals. India’s is bulk-heavy. That’s why, in terms of value per ton, India still lags behind. But the gap is shrinking. Indian companies are investing heavily in upgrading their plants to make higher-margin products.

What’s Driving Growth in India’s Chemical Industry

Three big trends are pushing India forward:

- PLI Scheme for Chemicals - The government’s Production Linked Incentive program offers up to 15% cash incentives on incremental sales for companies making key chemicals like lithium-ion battery materials, specialty polymers, and electronic-grade chemicals.

- Export Demand - With global supply chains shifting away from China, buyers from Europe, the U.S., and Southeast Asia are turning to India. Indian chemical exports to the U.S. grew by 32% in 2024.

- Domestic Consumption - More Indians are buying detergents, cosmetics, and packaged food - all of which need chemicals. The middle class is growing, and so is demand for everyday chemical products.

There’s also a quiet revolution happening in green chemistry. Companies like Tata Chemicals and GAIL are investing in bio-based solvents and carbon capture tech. One plant in Gujarat now uses captured CO2 to make urea - cutting emissions by 30%.

Challenges Holding India Back

Despite the progress, India’s chemical industry still faces big hurdles:

- Infrastructure gaps - Many plants still rely on diesel generators because power supply is unstable. Ports like Mundra and Nhava Sheva are congested, delaying exports.

- Environmental rules - Getting permits for new plants can take 2-3 years. Pollution control standards are strict, but enforcement is uneven.

- Skilled labor shortage - There aren’t enough chemical engineers trained in process safety or automation. Most universities still teach theory, not hands-on plant operations.

- Dependence on imported feedstock - India imports 70% of its crude oil and 50% of its ethylene. That makes production costs volatile.

These aren’t deal-breakers - but they’re the reasons India hasn’t jumped to number four yet.

What’s Next for India’s Chemical Industry

By 2030, India is expected to climb to the fourth-largest chemical producer globally, overtaking Germany and Japan. That’s the official projection from the Indian Chemical Council and the World Bank.

How? Two things: First, more investment in high-value chemicals - especially for EVs, solar panels, and semiconductors. Second, better integration with the pharma and agrochemical sectors. India already makes 20% of the world’s generic drugs - if it can make more of the raw chemicals itself, it’ll save billions in imports.

Startups are also stepping in. Companies like ChemVeda and GreenChem Labs are using AI to design new chemical processes, cutting development time from years to months. That’s the kind of innovation that could push India into the top three.

Final Take

India isn’t just a player in global chemical production - it’s becoming a pivot point. It won’t beat China on volume. It won’t beat Germany on precision. But it’s carving out a space where it’s the most reliable, cost-effective, and flexible supplier for bulk and pharma-grade chemicals.

If you’re buying chemicals for your business, India is no longer just an option - it’s a core part of the global supply chain. And if you’re watching from the sidelines, you’re already behind.

Is India the largest chemical producer in Asia?

No, India is the second-largest chemical producer in Asia, behind China. China produces over $1.5 trillion in chemicals annually, while India produces around $200 billion. India leads in certain segments like dyes and pharmaceutical intermediates, but China dominates in volume and scale across all categories.

Which Indian state produces the most chemicals?

Gujarat is the top chemical-producing state in India, accounting for nearly 40% of the country’s total output. It hosts the largest petrochemical complexes, including Reliance Industries’ Jamnagar refinery and the Dahej Special Economic Zone. Maharashtra and Tamil Nadu follow, contributing 25% and 15% respectively.

Does India export chemicals?

Yes, India is a major exporter of chemicals. In 2024, it exported $65 billion worth of chemical products, with key markets including the U.S., the U.K., the UAE, and Southeast Asia. Major exports include pharmaceutical intermediates, dyes, pesticides, and organic chemicals.

Why doesn’t India make more high-end specialty chemicals?

High-end specialty chemicals require ultra-pure raw materials, advanced automation, and highly trained engineers - areas where India still lags. Many of these chemicals are produced using proprietary technologies controlled by U.S. and German firms. India is investing in R&D and PLI schemes to close this gap, but it will take 5-10 years to catch up.

How is India’s chemical industry affected by global trade policies?

India benefits from trade diversification. As Western countries look to reduce reliance on China, they’re turning to India for reliable chemical suppliers. However, anti-dumping duties from the U.S. and EU on certain Indian chemicals (like dyes and titanium dioxide) have created challenges. Indian companies are responding by upgrading quality and moving into higher-value segments to avoid price-based competition.