Processed Food Company Comparison Tool

Compare Top Processed Food Companies

See revenue comparisons between major global processed food companies. Select multiple companies to view their revenue figures side by side.

Select Companies to Compare

Comparison Results

When you walk into a grocery aisle, the brands you see are often owned by a handful of global giants. But which one actually sits at the top of the processed‑food pyramid? In 2024, the answer is clear: the biggest processed food company is Nestlé. Below we break down why Nestlé holds the crown, how we measure size, and which other behemoths share the spotlight.

How "biggest" is measured in food processing

Size can be sliced in many ways-sales volume, employee count, or market reach. For a fair, comparable view we rely on annual revenue, the metric most investors and analysts use. Revenue reflects the money a company pulls in from all its product lines, giving a single‑number snapshot of market dominance.

We pull the latest figures from audited 2023‑2024 financial statements, convert everything to US dollars, and adjust for inflation where needed. This method keeps the comparison apples‑to‑apples, even when a firm sells a mix of snacks, beverages, and frozen meals.

Meet the leader: Nestlé is a Swiss multinational that manufactures a broad range of processed foods, from coffee and dairy to pet nutrition and bottled water. In 2023, Nestlé reported US$ 58.2billion in revenue, employing roughly 273,000 people across 190 countries.

Founded in 1866, Nestlé grew from a single milk‑powder plant into the world’s most diversified food processor. Its portfolio includes household names like Kit Kat, Nespresso, Maggi, and Purina. The company’s massive R&D budget-over US$ 3billion a year-lets it stay ahead of taste trends, nutrition science, and sustainability goals.

Key reasons Nestlé stays on top:

- Geographic reach: Presence in virtually every market, with strong footholds in Europe, North America, and emerging economies.

- Product breadth: Over 2,000 brands spanning 23 categories, reducing reliance on any single segment.

- Acquisition engine: Strategic purchases like the 2023 buyout of Freshly (ready‑to‑eat meals) added high‑growth categories.

Who else is in the top tier?

The processed‑food landscape is crowded, but a few names consistently rank near the summit.

| Company | Revenue (US$bn) | Headquarters | Main product groups | Employees |

|---|---|---|---|---|

| PepsiCo | 79.5 | Purchase, USA | Snacks, beverages, nutrition | 291,000 |

| JBS | 71.8 | São Paulo, Brazil | Meat processing, poultry, pork | 225,000 |

| Mondelez International | 28.6 | Chicago, USA | Biscuits, chocolate, gum | 106,000 |

| General Mills | 19.2 | Minneapolis, USA | Cereals, snacks, frozen foods | 35,000 |

| Kraft Heinz | 26.3 | Chicago, USA | Condiments, sauces, cheese | 38,000 |

Even though PepsiCo’s revenue tops the list, it’s primarily a beverage and snack company. When we talk strictly about “processed food” (anything that undergoes transformation beyond basic agricultural production), Nestlé’s diversified portfolio nudges it into the lead.

Beyond the numbers: market share and global footprint

According to the latest Euromonitor International report, the top five processors together control roughly 38% of global packaged‑food sales. Nestlé alone accounts for about 12% of that slice, making it a key driver of taste trends worldwide.

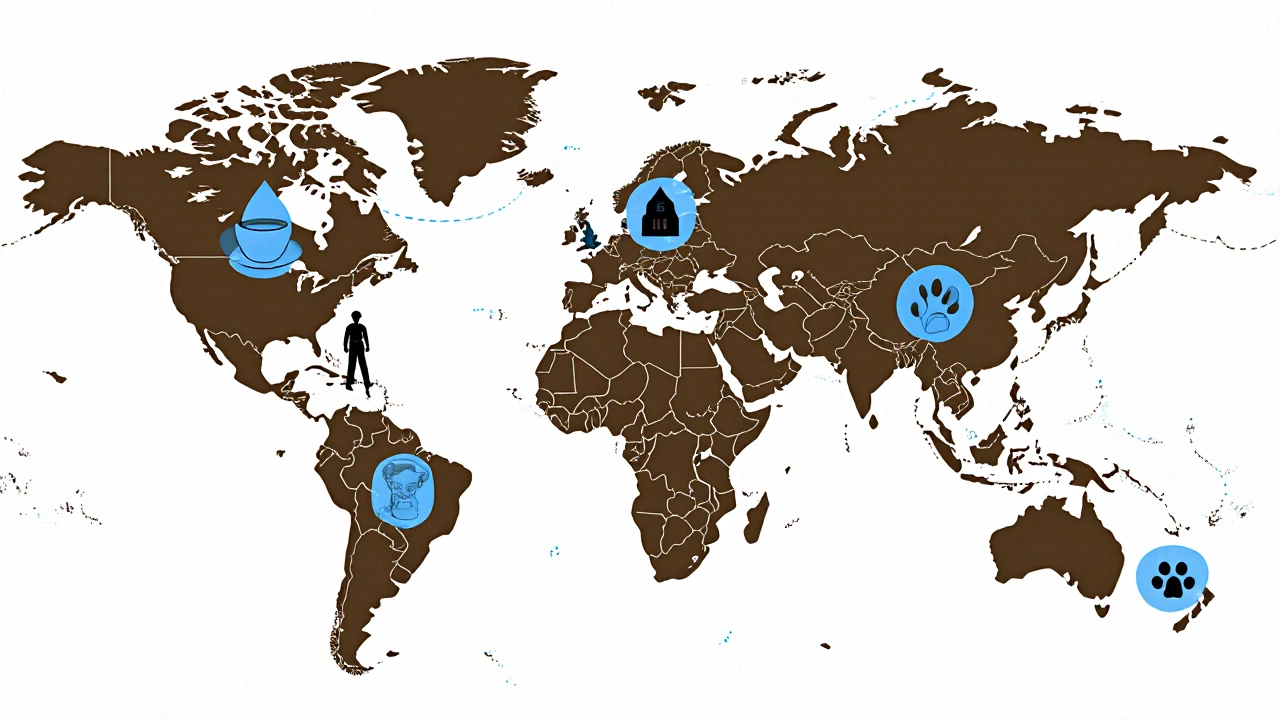

Geographically, Nestlé’s sales are split roughly as follows:

- Europe: 30%

- North America: 25%

- Asia‑Pacific: 28%

- Rest of World: 17%

This balance shields the firm from regional downturns. When the EU tightened labeling rules in 2024, Nestlé’s strong presence in North America helped offset any short‑term dip.

What the industry looks like in 2025

Two trends are reshaping the processed‑food arena:

- Health‑first reformulation: Companies are cutting sugar, salt, and saturated fats to meet stricter regulations in the UK, EU, and US. Nestlé announced a 15% reduction in added sugars across its breakfast cereals in early 2025.

- Sustainability pushes: Plant‑based alternatives and circular‑economy packaging are no longer niche. PepsiCo’s recent $2billion investment in biodegradable bottles and JBS’s move toward regenerative cattle farming illustrate the shift.

These moves affect not just the bottom line but also brand perception. A 2024 Nielsen survey found that 62% of shoppers prefer products from firms with clear sustainability commitments-a number that’s climbing each year.

Quick takeaways

- **Nestlé** is the biggest processed food company by revenue, with US$58.2bn in 2023.

- PepsiCo, JBS, Mondelez, GeneralMills, and KraftHeinz round out the top six.

- The top five firms control roughly 38% of global packaged‑food sales.

- Health‑focused reformulation and sustainability are the two biggest drivers of change in 2024‑2025.

- Geographic diversification keeps the leaders resilient against regional market shocks.

Frequently Asked Questions

Which company generates the most revenue from processed foods?

Nestlé tops the list with US$ 58.2billion in 2023 revenue, making it the biggest processed food company globally.

How do we define a "processed food" company?

A processed‑food company transforms raw agricultural products into packaged items-snacks, meals, beverages, dairy, meat products, or any goods that undergo industrial preparation, preservation, or fortification.

Is PepsiCo larger than Nestlé?

PepsiCo reports higher total revenue (US$ 79.5bn) but a larger share of that comes from beverages and snack chips. When focusing strictly on processed foods, Nestlé’s broader product mix places it ahead.

What are the biggest trends shaping the processed‑food industry?

Health‑first reformulation (less sugar, salt, fat) and sustainability (plant‑based options, recyclable packaging) dominate current strategies across the leading firms.

How many people does Nestlé employ worldwide?

Around 273,000 employees across 190 countries, according to the 2023 annual report.