Technical Textiles Revenue Calculator

Technical textiles now generate 30-50% higher margins than traditional apparel. This calculator shows how shifting production to technical textiles could impact your revenue based on 2024 industry data. According to the article, India is the third-largest producer of geotextiles and second-largest in medical textiles, with government targets of $10 billion in technical textile exports by 2030.

Revenue Analysis

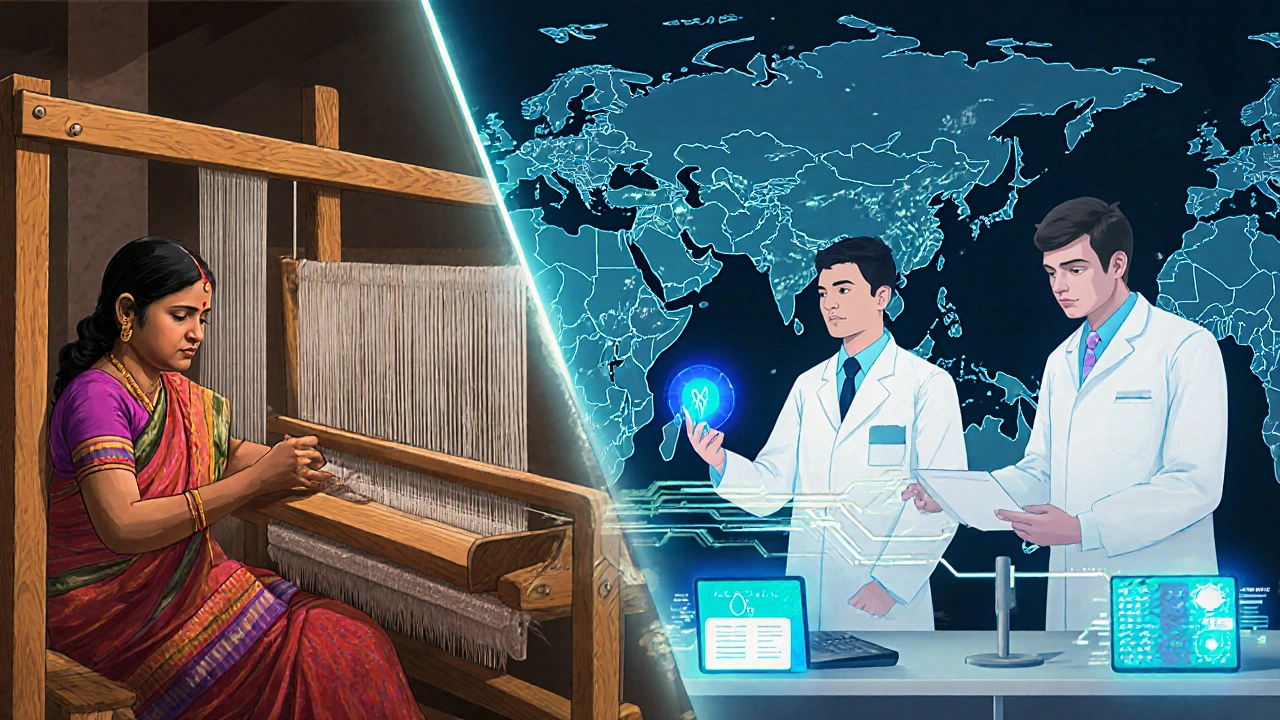

India’s textile industry isn’t just about handlooms and saris anymore. In 2024, it’s a $150 billion powerhouse that employs over 45 million people - more than any other manufacturing sector in the country. From small spinning units in Tamil Nadu to massive integrated factories in Gujarat, the industry is reshaping itself faster than most people realize. If you’re wondering what’s really happening on the ground, the answer isn’t just about growth numbers. It’s about who’s winning, who’s struggling, and where the real opportunities lie.

Exports Are Driving the Surge

India shipped over $42 billion worth of textiles and apparel in 2023, and early 2024 data shows that trend is holding. The U.S. and EU remain top buyers, but the biggest shift is happening in Southeast Asia and the Middle East. Bangladesh lost some market share in the U.S. due to labor and compliance issues, and India stepped in. Companies like Arvind Limited and Welspun India are now supplying major U.S. retailers like Target and Walmart with sustainably certified cotton fabrics.

What’s changing? It’s not just volume - it’s value. Indian exporters are moving up the chain. Instead of just selling raw cotton yarn, they’re exporting finished garments, technical textiles, and home furnishings. Technical textiles - think medical gowns, geotextiles for roads, and fire-resistant fabrics - grew by 22% in 2023. That’s not something you see in old textbooks. It’s happening now.

Government Policies Are Shifting the Game

The Production Linked Incentive (PLI) scheme for textiles, launched in 2021, is finally showing results. In 2023, over ₹18,000 crore (about $2.2 billion) in incentives were approved for 127 companies. These aren’t just big names - hundreds of medium-sized manufacturers got cash support to upgrade machinery, automate looms, and adopt digital design tools.

The government also pushed for domestic cotton production. In 2023, India produced 6.1 million bales of cotton - the highest in five years. That means less reliance on imports, lower input costs, and better margins for mills. Add to that the new Foreign Trade Policy 2023-28, which gives exporters duty-free access to raw materials, and you’ve got a system designed to keep Indian textiles competitive globally.

Technology Is No Longer Optional

Walk into a modern textile plant in Surat or Ludhiana today, and you won’t see workers manually threading yarn. You’ll see automated ring spinning machines, AI-powered quality control cameras, and digital looms that adjust tension in real time. The average Indian textile unit used to run on 1980s-era equipment. Now, over 30% of the top 500 manufacturers have invested in Industry 4.0 tech since 2022.

One company in Maharashtra cut fabric waste by 37% after installing a digital pattern-making system. Another in Tamil Nadu reduced dyeing time by 40% using smart water recycling units. These aren’t lab experiments - they’re daily operations. The cost of automation has dropped, and the ROI is clear: faster turnaround, fewer defects, and better compliance with EU and U.S. sustainability rules.

Challenges Still Loom Large

Don’t get it wrong - the road isn’t smooth. Power costs in some states are still 20% higher than in Bangladesh or Vietnam. Skilled labor is scarce. Many workers can operate a loom, but few can troubleshoot a PLC-controlled machine. Training centers are popping up, but they’re not keeping pace.

Then there’s the sustainability pressure. The EU’s Carbon Border Adjustment Mechanism (CBAM) will hit textile imports in 2026. Indian mills that still use coal-fired boilers or dump untreated dye waste are at risk. Only 12% of Indian textile units have certified environmental management systems. That’s a ticking clock.

Small players - the ones with fewer than 50 employees - are getting squeezed. They can’t afford automation, compliance audits, or design teams. Many are being pushed out by larger firms that can scale and meet global standards. Between 2022 and 2024, over 1,200 small textile units shut down in Uttar Pradesh and West Bengal alone.

Who’s Winning in 2024?

The winners aren’t the biggest names - they’re the smartest. Companies that combine three things: vertical integration, digital tools, and export focus.

- Arvind Limited owns cotton farms, spinning mills, weaving units, and garment factories - all under one roof. They control quality and cost from seed to shirt.

- Welspun India dominates the global bed linen market. Their U.S. sales grew 31% in 2023 because they certified every product with GOTS (Global Organic Textile Standard).

- KPR Mill in Coimbatore exports 80% of its output. They use AI to predict fashion trends and adjust production within 72 hours - faster than many European brands.

These aren’t lucky breaks. They’re strategic moves. They invested early. They hired data analysts, not just engineers. They built relationships with global retailers, not just local traders.

The Real Opportunity: Technical Textiles

Most people think of cotton shirts and denim when they hear "Indian textile." But the future is in technical textiles - fabrics engineered for function, not fashion.

India is now the world’s third-largest producer of geotextiles (used in roads and dams), and the second-largest maker of medical textiles. In 2024, the government set a target of $10 billion in technical textile exports by 2030. That’s a $2 billion jump in six years.

Why does this matter? Because technical textiles have higher margins - often 30-50% more than regular apparel. They’re not subject to fashion cycles. They’re bought by hospitals, defense agencies, and infrastructure projects. And they’re harder to copy.

Startups like TexPro in Hyderabad are making smart fabrics that monitor heart rate for elderly patients. GreenTex in Coimbatore produces biodegradable nonwovens for packaging. These aren’t niche experiments - they’re scaling fast.

What’s Next? The Next 12 Months

By mid-2025, expect three big shifts:

- More mergers. Small mills will sell to bigger players to survive.

- More green factories. Expect 50+ new plants with solar roofs and zero liquid discharge systems.

- More direct-to-consumer brands. Indian textile companies are launching their own retail labels - bypassing middlemen and capturing more profit.

If you’re a buyer, supplier, or investor, don’t look at India as a low-cost producer anymore. Look at it as a fast-moving, tech-savvy, export-driven industry that’s redefining what textiles can be.

Frequently Asked Questions

Is the Indian textile industry growing in 2024?

Yes, the Indian textile industry is growing steadily in 2024, with exports hitting $42 billion in 2023 and projected to rise further. Growth is being driven by increased demand for technical textiles, government incentives, and automation. The sector added over 1.2 million new jobs in the last two years, and manufacturing output rose by 7.5% year-over-year.

What are the biggest challenges facing Indian textile manufacturers?

The biggest challenges include high energy costs, lack of skilled labor for modern machinery, and pressure to meet global sustainability standards. Many small manufacturers can’t afford the upgrades needed for EU and U.S. compliance. Water pollution from dyeing units and outdated equipment are also major issues. Without investment, these firms risk being left behind.

How is the PLI scheme helping textile manufacturers?

The Production Linked Incentive (PLI) scheme gives cash rewards to manufacturers based on how much they increase production and exports. Since 2021, over ₹18,000 crore has been approved to 127 companies. This has helped firms buy automated looms, digital printers, and eco-friendly dyeing machines. The scheme is especially helping mid-sized companies that couldn’t afford upgrades before.

Why are technical textiles important for India’s future?

Technical textiles - like medical fabrics, geotextiles, and protective gear - have higher profit margins and stable demand. Unlike fashion textiles, they aren’t affected by seasonal trends. India is already the third-largest producer of geotextiles and second-largest in medical textiles. The government aims to export $10 billion in this segment by 2030, creating high-value jobs and reducing import dependence.

Can small textile units survive in 2024?

It’s getting harder. Over 1,200 small units shut down between 2022 and 2024. Those that survive are either joining cooperatives, outsourcing design and compliance to third parties, or specializing in niche products like handloom or organic cotton. Without access to finance, technology, or export networks, most small players can’t compete with larger, integrated firms.

Is India becoming a rival to China in textiles?

India isn’t replacing China yet, but it’s taking share in specific segments. China still leads in volume and speed. But India is winning in sustainability, customization, and compliance. Western brands are diversifying away from China due to geopolitical risks, and India’s transparent supply chains and cotton advantage make it a preferred alternative for mid-to-high-end buyers.